About the project

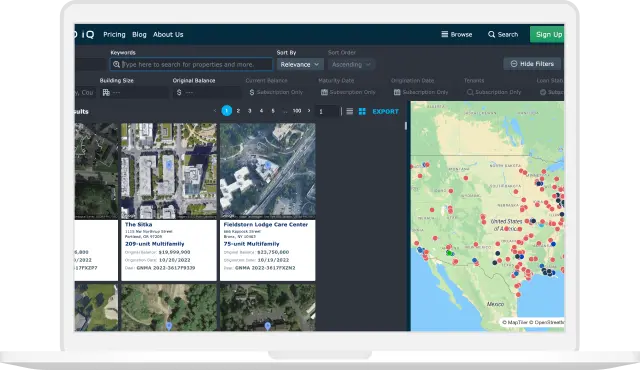

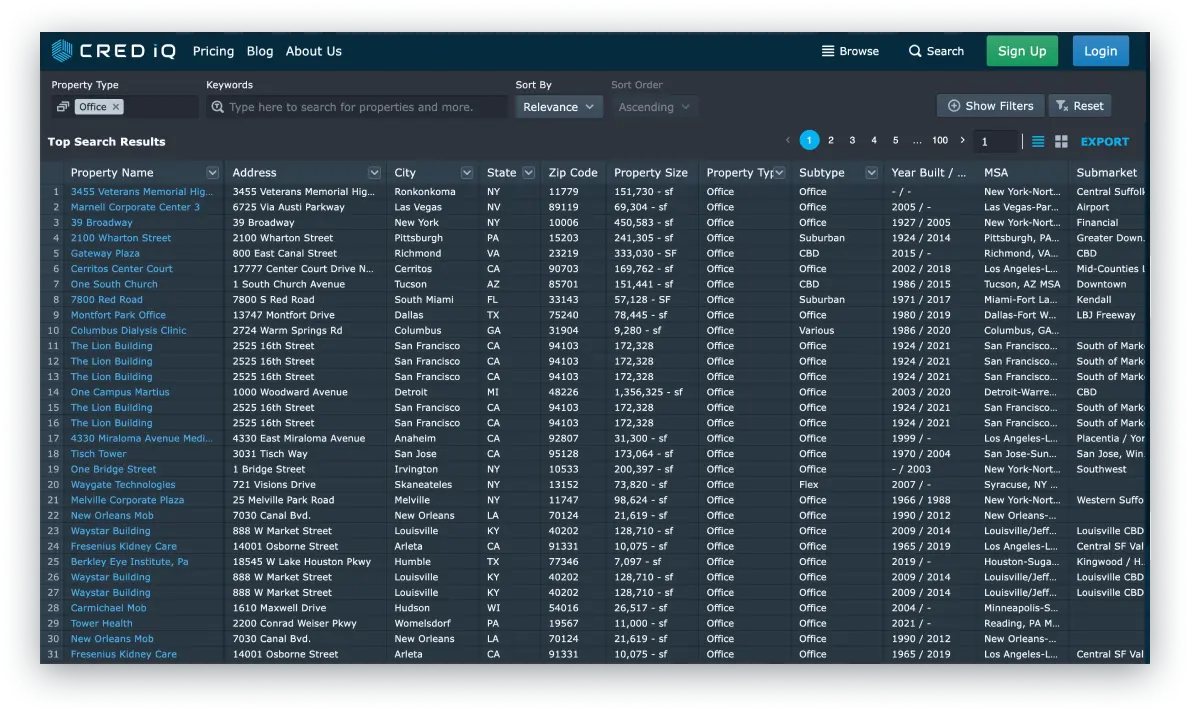

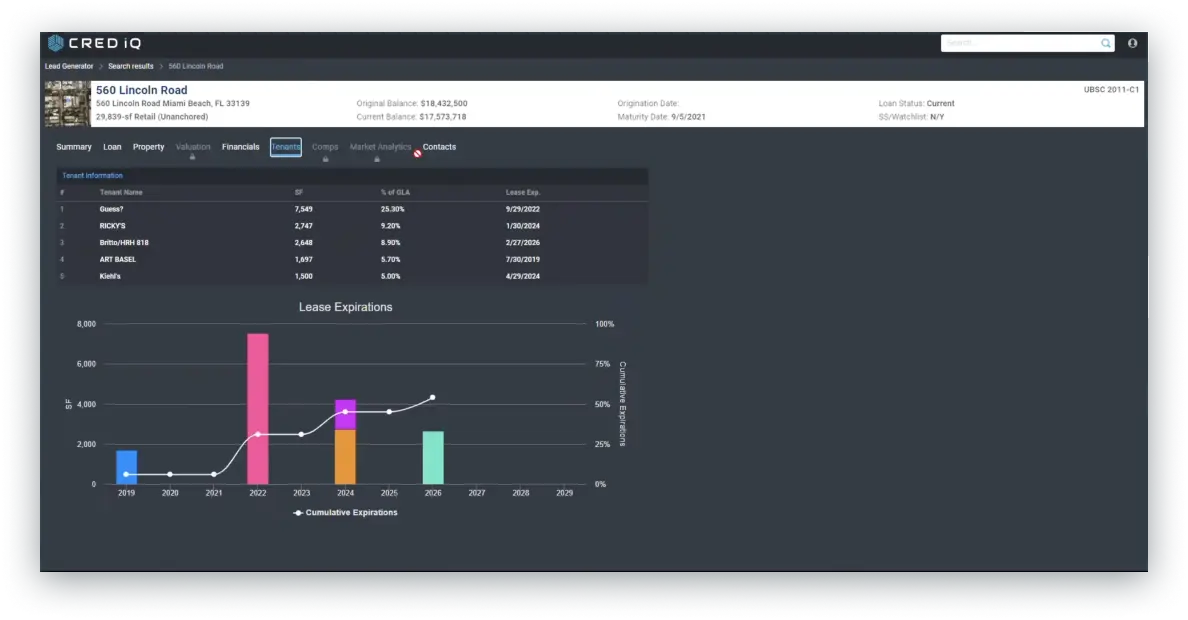

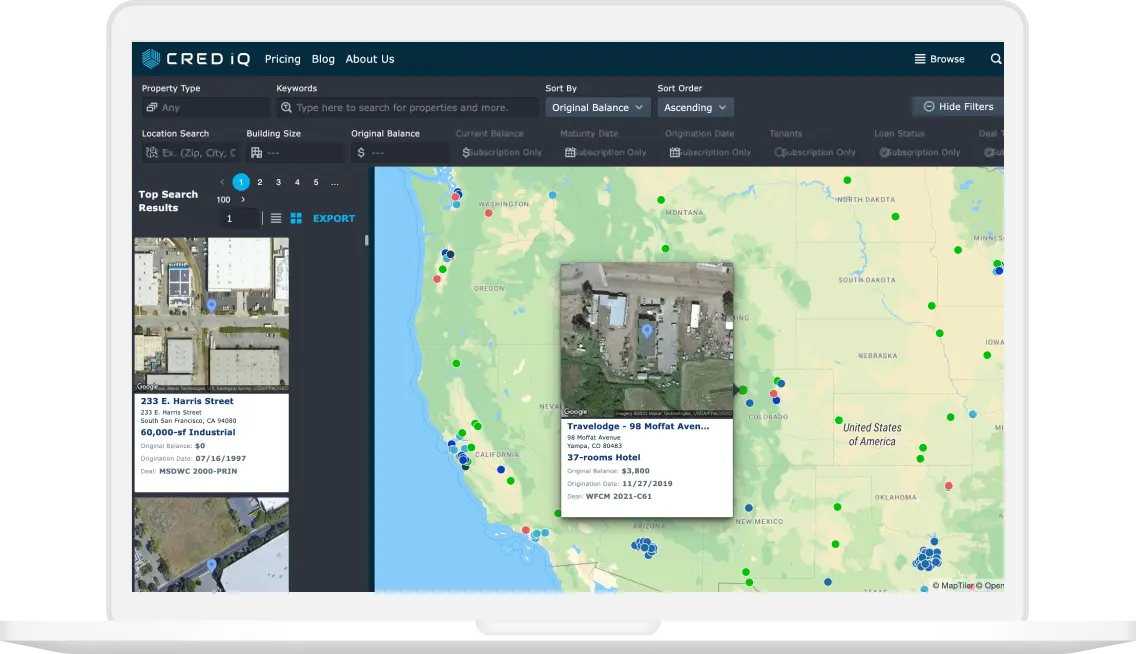

Cred IQ serves as a data, analytics, and valuation partner that helps commercial real estate professionals uncover financing, leasing, and investment opportunities. The company grants clients access to $2.0 trillion of commercial real estate data property, giving access to market and economic insights – from maturic loans to expiring leases.

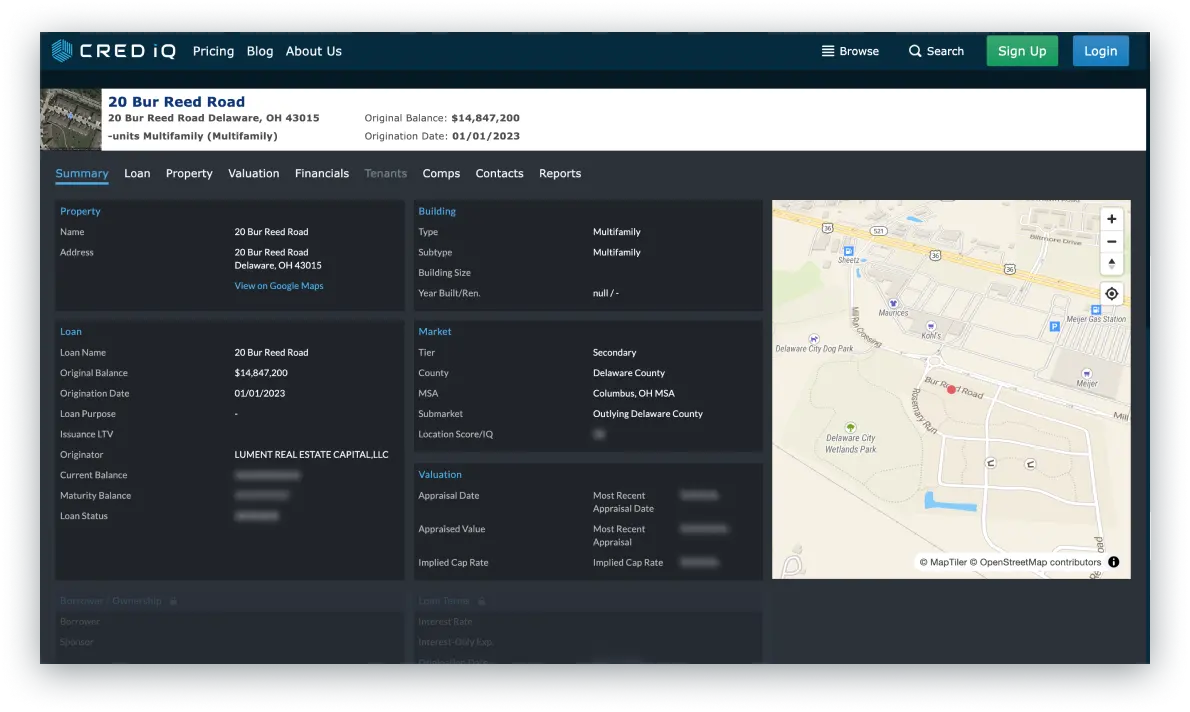

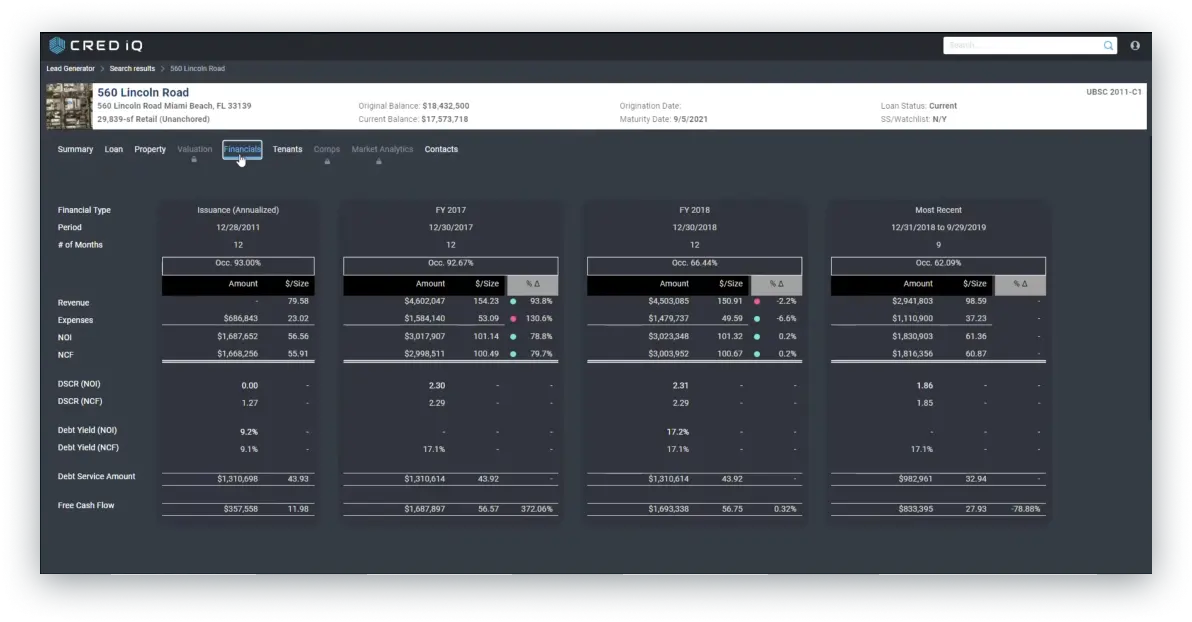

With Cred IQ help, companies can assess property valuation by applying cash flow analysis. The Operating Advisor team supports customers in making better decisions and oversees CMBS trusts. Cred IQ integrates data directly into an analytics platform or enriches existing data with valuable insights.

Challenges that was faced and overcame

Technologies used

Our experienced engineers employ the latest technologies, frameworks, and components to create solution that combine a strong easy-to-use modern design with high performance

Team Structure

Value delivered

As a result of our cooperation, Cred IQ obtained an enhanced platform with extensive capabilities. The standout feature of the platform is its comprehensive list of data points, including loan details, property information, tenant data, valuations, borrower/ownership information, contact details such as phone numbers and emails, addresses, financial information, and over 500 additional data points per property. This rich dataset empowers users to delve into the vast CRE universe and explore opportunities like never before. The value delivered lies in providing a robust platform that equips brokers, lenders, and investors with the tools they need to make informed decisions and uncover valuable insights in the commercial real estate market.

Cases you may like